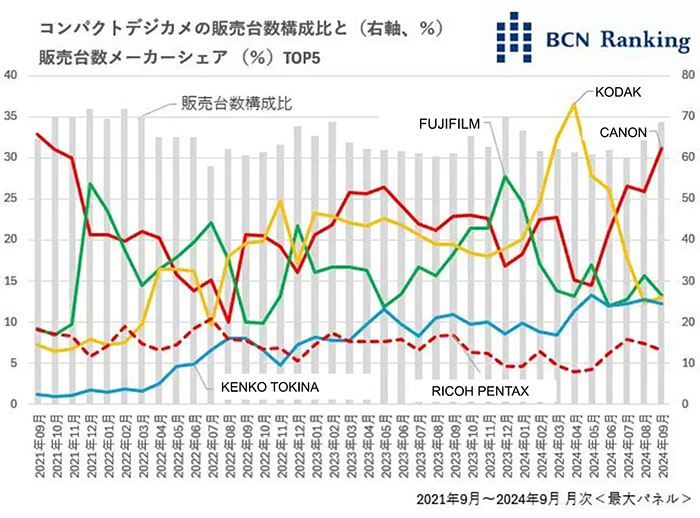

Compact cameras still account for more than 60% of the number of cameras sold

Image translation via PetaPixel. Sony is totally absent here.

The Japanese organization BCN shared new insights on the Japanese fixed lens camera market. Digicameinfo summed up the most interesting points:

- Casio has left the compact camera market, Nikon has stopped development, and Sony and Fujifilm have significantly scaled back their lineups. Some may fear that the category itself will disappear as it is pushed aside by smartphones. The bottom line is that it is not dead at all. Compact cameras still account for more than 60% of camera sales. Although their sales value composition ratio is small, ranging from the upper 20% to lower 30%, a certain level of sales continues.

- The average price is also rising, just like with interchangeable lens cameras. In particular, the increase in the proportion of relatively high-priced models over 50,000 yen stands out. As of September 2021, this was only 6.8% of the total number of units sold, but this September it had risen to 33.2%. This is thought to be largely due to the impact of inflation, but at the same time, it is also highly likely that there are an increasing number of users who want better products even if they are a little more expensive.

- Year-on-year sales of interchangeable lens cameras fell significantly in both unit volume and value. Although the decline narrowed in October, sales remain below the previous year’s level. Compact cameras are also showing a slowdown, with unit sales declining slightly in September and October. However, sales value remained above the previous year, with October sales value increasing by double digits to 115.3%. With prices of mirrorless cameras rising, it could be said that even relatively high-priced compact cameras are now looking cheap.

- The compact camera market structure has changed significantly in the past few years. Canon is by far the top five in terms of sales volume in September, with a large share of 31.1%, backed by the PowerShot and IXY series. Meanwhile, Fujifilm, in second place, took a 13.4% share, largely due to the huge sales of its instax mini Evo. Kodak and Kenko Tokina, in third and fourth place, moved into the “vacant lot” left by major manufacturers. They are the main players who have expanded their market share by leveraging their good cost performance, and have greatly changed the market. And Ricoh Imaging, with its GR series, has made it into the top five with a modest single-digit share. The GR brand, which has been around since the film era, still has many die-hard fans.

I wonder if 2025 will be the year where Sony finally revives their RX camera series. What do you think…is this going to happen or not?